“This is a sponsored post by UnitedHealthcare. All thoughts and opinions are my own.”

“This is a sponsored post by UnitedHealthcare. All thoughts and opinions are my own.”

A few weeks ago I wrote a blog post about small business health insurance. In that post, I wrote about three reasons that small business owners need to offer health insurance for their employees. I also wrote about how different it is today to purchase health insurance versus what it looked like 10, 15 or 20 years ago when I owned my trucking company.

I remember how frustrating it was to look through all the plan options that my agent would bring me. Never quite feeling like I was completely informed about all the possibilities. I always dreaded the 4th quarter of the year because it meant hours and hours and hours of time spent searching for healthcare insurance for our company.

If you have experienced that painful process when you have searched for small business health insurance, I’ve got some great news for you. There is a place where you can make a highly informed decision – fast and painlessly. And the best thing about it is that it is only going to take you about 20 minutes.

HealthCare Insurance for You and Your Employees in 20 Minutes

Recently, while working with a consulting client, I suggested that they look at the UnitedHealthcare site. In less than 20 minutes they registered for a free account by simply entering their zip code, number of employees and estimated policy start date and had 6 different quotes for themselves and their employees. It was really easy and what I think they loved the most was that the entire process was explained in a way that helped them to feel confident in what they were choosing.

The entire process is divided into 3 main parts – the medical plans, your employee details and your monthly budget.

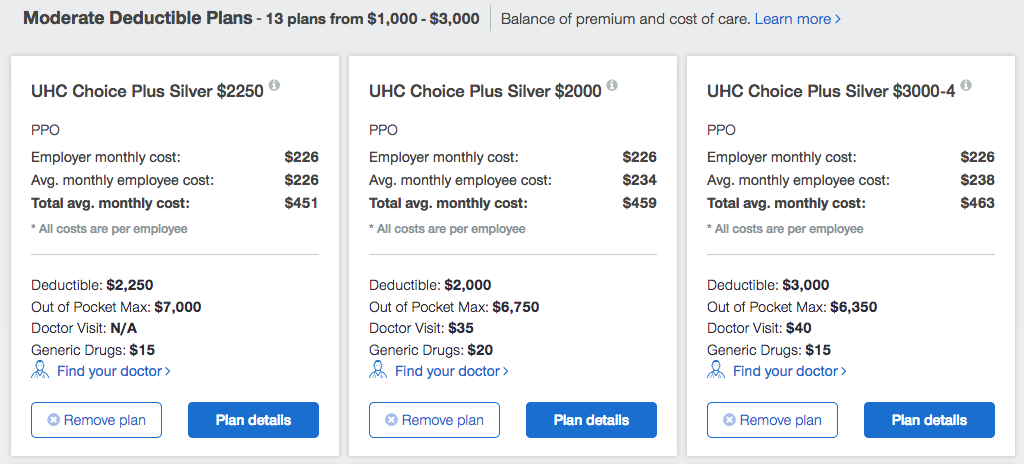

Choosing the Medical Plans

After logging in, the system showed us 6 different medical plan options. The plans ranged from high deductibles to mid and low deductibles. It showed exactly what each different plan will cost the employer and what it will cost the employee on average. For this client, the deductible was the important determining factor so we sorted the entire list by deductible and we could have also sorted by network or metal tier. Then all we had to determine was whether we wanted to offer the employees all 6 options or just certain ones. We could easily see the cost to the employee, the deductible, the out of pocket maximum, the cost for doctors’ visits and prescriptions.

I can tell you those are the first 5 questions I always got from our employees. All of the other details about the policy are only a button away so the employee will be able to easily get the answers to other questions they have. And if we chose to offer all 6 of the plans, then the employees can use the Employee Fit Finder Tool to narrow down their choices by what is most important to them.

The Employee Details

Once we decided on the policies, the second step was to put in some information about the employees. We didn’t need to know everything about the employees when we were sitting there the first time but by putting in as much information as we could we knew that we would get a more solid quote so there wouldn’t be surprises later. We started with employee initials, zip code, age and gender. There was also an option to add spouses and children.

Oh and if we didn’t want to sit there and enter them one by one we were given the option to upload a Xero, Excel or Quickbooks file. We didn’t have many employees so we did it manually but back in my trucking days with almost 50 employees I would have gladly uploaded an Excel spreadsheet.

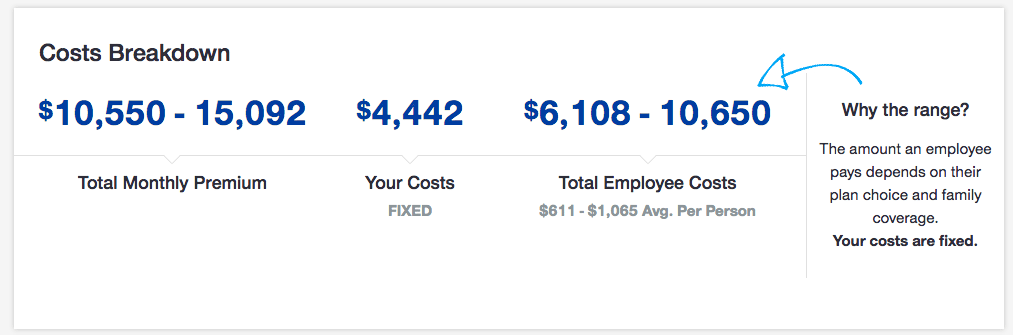

Your Budget

The third part of the process was the budget. Using the interactive sliding tool we chose what we, as the employer, were willing to pay each month for our portion of the employee’s coverage. The employee would then pay the remainder of the cost based on the plan they choose. The cost breakdown was clear and concise. It showed the total monthly premiums, our cost as the employer and how much the employees were going to pay. At this point that is an estimation because the employees haven’t chosen their plans yet but it still gave us a picture of what was going to occur.

Oh and the other thing my client really liked was that the process was being saved along the way. There was a point where they had to stop to take care of something else and they were able to go back to the site later and pick up where they left off.

The site made the final steps easy. You simply confirm that the benefit packages and billing information are correct (and you can download a pdf of the entire proposal) and then you are taken to an easy online shopping cart. You can connect with a coverage advisor at any time in the process. They make sure everything is set up correctly in the UnitedHealthcare system and also can help you with any additional benefits you might want to add.

The fact is this process went quickly and smoothly. It has probably taken me longer to write this post about our experience than the full time we spent on the site. If you haven’t visited UnitedHealthcare for your small business health insurance yet then you should take the time to do that now.