Becoming a small business owner is a major life decision, and it is not for everyone. However, the appeal of financial independence and flexibility is undeniable for those of us who have the entrepreneurial bug.

Becoming a small business owner is a major life decision, and it is not for everyone. However, the appeal of financial independence and flexibility is undeniable for those of us who have the entrepreneurial bug.

And just because you start a business does not guarantee financial freedom. The sad truth is that most business owners never reach their dream.

What did he mean by personal resources? The things you own (or at least have a title to). Maybe it is real estate or equipment that you lease or an online membership that pays monthly.

5 Key Elements of Financial Independence for Small Business Owners

Determine your Freedom Point

Knowing how to become financially independent begins with knowing what your number is. Everyone's number is different and is calculated by looking at your investments, the value of your business, and any retirement you are expecting. You can use the free Freedom Point Calculator to work through the calculations to know your number.

Determine the current value of your business

For most small business owners, their largest asset is their business. As a certified business value builder, I have to tell you that most entrepreneurs think their business is worth more than it currently is. Complete the Value Builder Assessment to determine the actual current value of your business.

Outline the plan to get the value of your business or businesses to the point that it achieves your financial independence

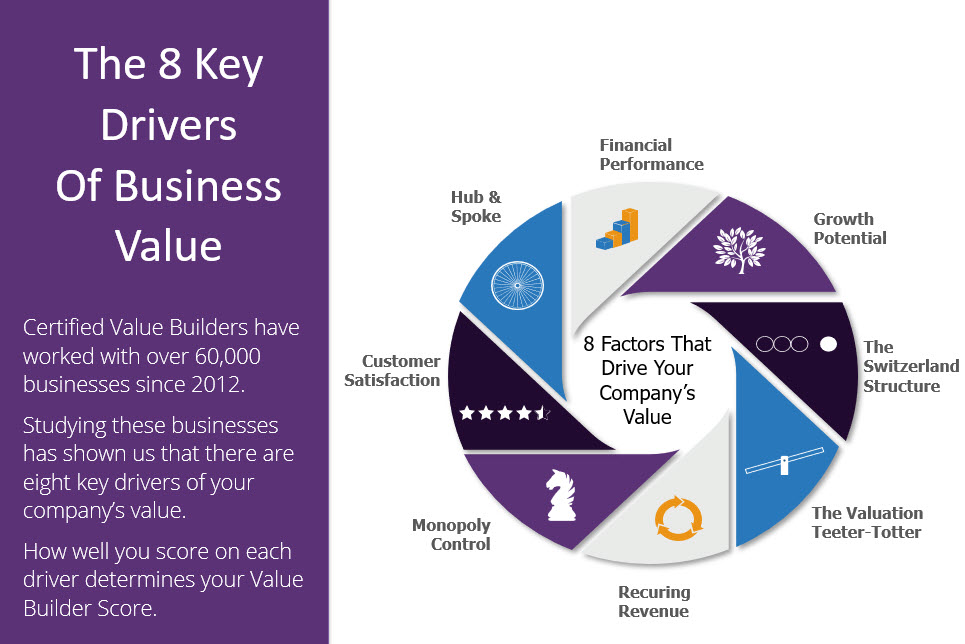

The Value Builder Assessment will analyze the eight areas in business that can add to or detract from the value of your business. These areas include financial, growth potential, recurring revenues and how reliant your business is on you, and more.

8 Key Drivers of Business Value

Create the metrics to track your progress

If the Freedom Point Calculator determined that your business needs to be worth $10 million for you to be financially independent and currently it's at a valuation of $4 million, what is your plan to grow the business?

If you can increase your business value by 20% a year, you could reach your goal in 5 years. The most direct metric is the annual percentage of valuation increase. Other metrics may be an increase in recurring revenues or numbers of sales calls.

Invest in leverageable assets

Jim Rohn said, “To become financially independent, you must turn part of your income into capital; turn capital into enterprise; enterprise into profit; turn profit into an investment, and turn investments into financial independence.”

As your business value is growing, you will have the cash to invest in leverageable assets. That may be real estate, equipment, online memberships, or other businesses.

The majority of entrepreneurs began their businesses to regain control over their time and create financial independence. It doesn't matter where you sit today in this process. If you want to achieve it, you must start by understanding your goal and paying attention to how you're achieving it.

Join me for the Entrepreneurial Freedom Livestream

During the Livestream, I will be showing you exactly how these eight drivers of business value are helping you or hurting you. With some simple strategies, we can directly increase the value of your business and get you to financial independence even quicker.